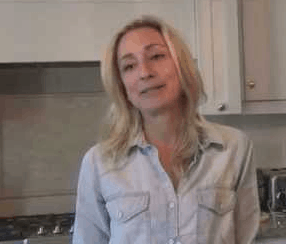

Haena Park Charged with Defrauding More than 20 Individual Investors

LawFuel.com – 2016 Law News Site – Preet Bharara, the United States Attorney for the Southern District of New York, and Angel M. Melendez, Special Agent in Charge of the New York Field Office of the Department of Homeland Security, Homeland Security Investigations (“HSI”), announced today that HAENA PARK was arrested this morning on commodities fraud and wire fraud charges stemming from her scheme to defraud more than 20 investors of more than $23 million in which PARK solicited investments for the purpose of trading in a variety of securities and commodities, including off-exchange foreign currency contracts, through the use of false and misleading statements about, among other things, her historical trading performance. PARK was arrested this morning in Manhattan, New York, and was presented today before United States Magistrate Judge Andrew J. Peck.

U.S. Attorney Preet Bharara said: “Haena Park is charged with lying to prospective investors about her remarkably high returns and trading expertise in the forex markets to lure them into investing with her. Through deceit, we’ve alleged, she raised more than $23 million from victims and lost nearly all of it. Then to cover up trading losses, she allegedly sent fictitious statements to investors and used money from new investors to pay other investors back.”

HSI Special Agent in Charge Angel M. Melendez said: “It is alleged that Haena Park defrauded investors and covered up millions of dollars in financial losses with fake documents and lies that may devastate the financial security of these victims. HSI and its El Dorado Task Force partners are committed to investigating those who seek to exploit vulnerabilities in the US Financial System.”

According to the Complaint unsealed today in Manhattan federal court[1]:

From in or about January 2010 through in or about June 2016, HAENA PARK, the defendant, raised more than $23 million from more than 20 individual investors, purportedly for the purpose of trading in a variety of securities and commodities, including equities, futures, and off-exchange foreign currency (“forex”) transactions. In connection with the scheme, PARK made a series of false and misleading representations to investors, including that PARK was an accomplished forex trading advisor earning annualized returns as high as 48.9 percent for her investors. In truth and in fact, PARK was not an accomplished forex trader, her trading was consistently unsuccessful, and the trading results emailed to investors by PARK were false and did not reflect the trading losses actually incurred by PARK. Rather, from in or about January 2010 through in or about June 2016, Park lost approximately $19.5 million of the $20 million that she traded, including in commissions and fees, principally in highly leveraged futures and forex transactions.

To prevent or forestall redemptions by investors, and to continue to raise money from investors to fund her scheme, PARK generated fictitious account statements, which she sent to investors on a monthly basis. Instead of accurately reporting the trading losses PARK was suffering, the account statements indicated that the investors were making money nearly every month. To hide her trading losses, PARK used new investor funds to pay back other investors in a Ponzi-like fashion. In total, PARK distributed approximately $3 million back to investors from funds deposited by new investors.

* * *

PARK, 40, of Manhattan, New York, is charged with one count of commodities fraud, which carries a maximum sentence of 10 years in prison and a maximum fine of $1 million, or twice the gross gain or loss from the offense; and one count of wire fraud, which carries a maximum sentence of 20 years in prison and a maximum fine of $250,000, or twice the gross gain or loss from the offense. The maximum potential sentences in this case are prescribed by Congress and are provided here for informational purposes only, as any sentencing of the defendant will be determined by the judge.

Mr. Bharara praised the work of HSI and the El Dorado Task Force. He also thanked the Commodity Futures Trading Commission and the Securities and Exchange Commission, each of which filed civil charges against PARK today.

The charges were brought in connection with the President’s Financial Fraud Enforcement Task Force. The task force was established to wage an aggressive, coordinated and proactive effort to investigate and prosecute financial crimes. With more than 20 federal agencies, 94 U.S. attorneys’ offices, and state and local partners, it is the broadest coalition of law enforcement, investigatory and regulatory agencies ever assembled to combat fraud. Since its formation, the task force has made great strides in facilitating increased investigation and prosecution of financial crimes; enhancing coordination and cooperation among federal, state and local authorities; addressing discrimination in the lending and financial markets; and conducting outreach to the public, victims, financial institutions and other organizations. Since fiscal year 2009, the Justice Department has filed over 18,000 financial fraud cases against more than 25,000 defendants. For more information on the task force, please visitwww.StopFraud.gov.

This case is being handled by the Office’s Securities and Commodities Fraud Task Force. Assistant U.S. Attorney Christine I. Magdo is in charge of the prosecution.

The allegations contained in the Complaint are merely accusations, and the defendant is presumed innocent unless and until proven guilty.

16-147